Blog: 3 December 2025

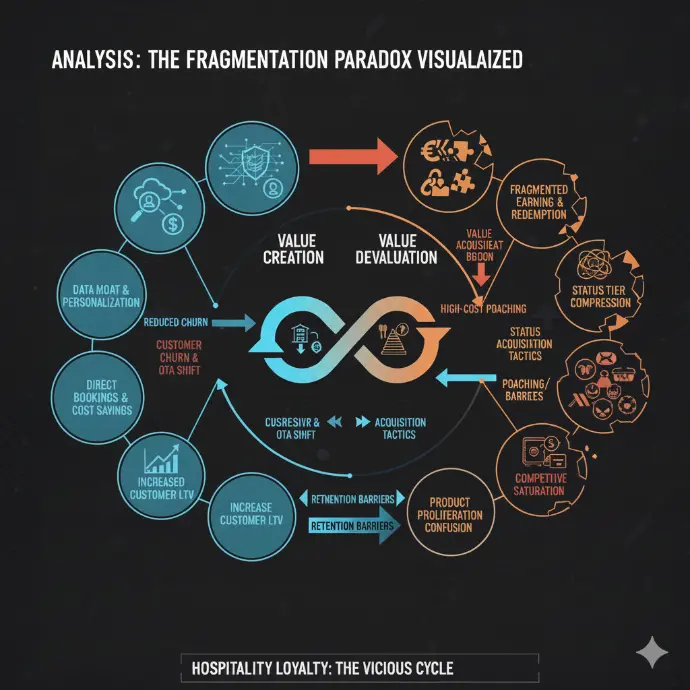

TL;DR: Hospitality loyalty programs are trapped in a Fragmentation Paradox: massive expansion across diverse assets (hotels, casinos, residences) drives complexity, devaluation, and customer fatigue, despite generating over 50% of direct bookings. The current, point-heavy model creates a significant multi-billion dollar deferred financial liability while forcing aggressive marketing tactics like status matching to combat competitive cross-pollination.

To ensure long-term value and digital resilience, programs must shift away from transactional complexity toward Experiential Simplicity by adopting dynamic, personalized rewards, prioritizing high-margin, asset-agnostic redemption options (dining, experiences), and returning to the basics to restore member trust.

Introduction: The Erosion of Loyalty Value

Hospitality loyalty programs, once simple point-based systems focused on room nights, have evolved into sprawling, multi-brand ecosystems encompassing hotels, residences, casinos, clubs and many more. This ‘fragmentation paradox’ aims to capture the entire customer travel wallet, but the complexity often results in a degraded member experience, dilution of point value, and a marketing challenge that obscures the core benefit.

The necessity of these programs is clear: loyal members typically contribute 2x to 3x higher RevPAR (Revenue Per Available Room) than non-members and exhibit a 35% lower cost of acquisition (Source: Major Hotel Group Financial Reports, 2024). The sheer scale of these programs is staggering: major players like Marriott Bonvoy and Hilton Honors command membership bases exceeding 190 million and 150 million active members, respectively (Source: Company Investor Reports, 2024). However, industry studies reveal that despite this enormous reach, the actively engaged rate—members who redeem or earn points annually—can be as low as 20-25%. This gap between enrollment and engagement is the defining challenge of hospitality loyalty.

The Current State: Complexity and Devaluation

Fragmentation is primarily driven by the necessity for large hotel groups to bring recognition to a diverse, recently acquired asset classes under a single brand umbrella. The loyalty currency must now serve a mid-market traveler, a high-roller at a casino, and a family purchasing fractional ownership at a resort residence.

This expansion has led to five core problems that we see:

- Inconsistent Earning and Redemption Ratios: Points are earned differently based on the asset (e.g., spending at a resort yields fewer points per dollar than a city hotel room), and redemption charts often feature non-linear, dynamic pricing that makes calculating value difficult. This fuels a sense of devaluation among members, a perception exacerbated by the elimination of fixed reward charts. The average value of a major hotel point has fluctuated by as much as 30% year-over-year (Source: Independent Loyalty Value Index, 2024), making future redemption planning impossible for customers.

- Status Tier Compression: The proliferation of elite tiers compresses the value of mid-to-high tiers. A 'Gold' member, for example, once enjoyed significant benefits (late checkout, upgrades) which are now standard for lower tiers, forcing true premium benefits higher up the chain and requiring unrealistically high stay counts for attainment. The number of distinct elite tiers across the top three global chains has increased by 40% over the last decade (Source: Loyalty Program Structure Analysis, 2024), pushing the requirements for meaningful benefits like guaranteed suite upgrades into the top 2% of the member base.

- Product Proliferation: Programs struggle to integrate non-hotel products—such as food delivery platforms, credit card partnerships, and retail collaborations—into a cohesive narrative. While these partnerships expand earning opportunities, they dilute the program's focus, turning it into a general rewards scheme rather than a specialized hospitality incentive. Major programs now maintain over 70 distinct non-hotel partnerships (including dining, retail, and travel accessories), which, while increasing earning avenues, results in only 15% of members accurately tracking their total point balance or utility.

- Massive Deferred Financial Liability: The continuous issuance of points, especially through high-volume credit card partnerships, creates a substantial liability on the corporate balance sheet, often exceeding up to hundreds of millions for major programs. This liability represent up to 15-20% of a hospitality group's total current liabilities, requiring long-term hedging and financial risk management, as it must be fulfilled regardless of the future profitability of the redeemed asset.

- Competitive Saturation and Brand Noise: The sheer volume of competing loyalty programs (across hotels, airlines, credit cards, and retail) creates an environment of customer fatigue and confusion. Members are often enrolled in 5 or more travel programs, diluting the perceived unique value of any single brand and making the cost of switching brands functionally negligible for many customers (Source: Global Travel Loyalty Survey, 2023).

Marketing Strategies and Retention Mechanics

The saturation and confusion from the core problems have forced programs to adopt aggressive, often financially burdensome, marketing and retention tactics. These strategies no longer focus solely on stay frequency but are designed to combat competitive cross-pollination—where members switch programs to arbitrage benefits—and capture customer financial data (wallet share). Programs employ dual marketing strategies: one for acquisition of the casual traveler, and another for retention of the high-value elite member.

Acquisition Strategies

Acquisition often relies on fast-tracking status and financial incentives:

- Co-Branded Credit Cards: These partnerships are the single most effective acquisition tool. They offer immediate mid-tier status upon sign-up, providing tangible benefits on the first stay. Co-branded card members typically spend 4x to 6x more on the card annually than general cardholders (Source: Credit Card Industry Benchmarks). This strategy effectively outsources customer acquisition costs while locking in financial rewards.

- Status Matching: Programs offer aggressive status matching to steal high-value elite members from competitors, particularly during new program launches or large-scale mergers. This increases the pool of high-cost elite members but can dilute the perceived value of existing members' efforts.

- Experiential Bait: Marketing focuses on non-room rewards, such as 'Money Can’t Buy' experiences (e.g., private concerts, chef meet-and-greets). This targets the emotional side of loyalty, aiming to differentiate the program from purely transactional competitors.

Retention Strategies

Retention mechanisms are focused on increasing the customer's Lifetime Value (LTV):

- Elite Tier Recognition: The most powerful retention tool is the sense of belonging and recognition. Dedicated elite lines, personalized communication, and guaranteed room availability at high tiers create a psychological barrier to switching brands.

- Soft Landings and Thresholds: Allowing elite members a "soft landing" (retaining a slightly lower status without meeting full requirements) prevents high-value members from immediately deflecting. Furthermore, setting high thresholds for the top tiers ensures that the most lucrative members are heavily invested.

- Targeted Spend Campaigns: Data analytics identify members whose spending is just below the next tier and offer personalized promotions to maximize short-term yield.

Analysis: The Good and The Bad of Loyalty Today

The core function of the current loyalty model is to establish an exclusive data moat. By consolidating spending across hotels, co-branded credit cards, and retail partnerships, chains gain an unparalleled 360-degree customer view, enabling specific price sensitivity modeling and personalized offerings that maximize profit and drive greater than 50% of direct bookings, circumventing expensive OTAs.

Aspect | The Good (Value Proposition) | The Bad (Liability) |

|---|---|---|

Financials | Drives greater than 50% of direct bookings, circumventing expensive OTAs (Online Travel Agencies). | Massive deferred liability on the balance sheet due to un-redeemed points, representing a significant financial risk if not strategically managed. |

Experience | Elite members enjoy personalized benefits that create positive word-of-mouth (UGC). | Point devaluation leads to member cynicism, negative social media backlash, and status poaching by competitors. |

Reach | Co-branded cards provide massive, low-cost marketing and a constant stream of high-intent travelers. | Complex rules and fragmentation create confusion, driving members to simplify and book via OTAs for convenience. |

Strategic Imperatives for Digital Resilience

To transition from managing liabilities to generating sustained equity, future loyalty programs must directly address the fragmentation paradox:

1. Radical Personalization and Dynamic Rewards

The future mandates a shift from static tier benefits (e.g., all Platinum members get 4 PM late checkout) to dynamic, AI-driven rewards. Programs must leverage data to offer the right benefit to the right person at the right time. For a business traveler, this might mean guaranteed 6 AM check-in, while for a leisure traveler, it means a free resort credit. This moves away from the one-size-fits-all model that drives up costs without guaranteed satisfaction.

2. Asset-Agnostic Redemption

Loyalty must shift to non-room revenue redemption, where points are more easily converted into dining experiences, spa treatments, local tours, or even branded merchandise. Industry data indicates that redemption for non-room ancillary services is growing, accounting for over 30% of total redemptions in some forward-thinking programs (Source: Loyalty Program Trend Reports, 2024). This not only reduces the deferred liability of points but also drives high-margin revenue streams.

3. Subscription and Fee-Based Models (Premium Loyalty)

Some programs are experimenting with paid, subscription-based elite access. For an annual fee, members receive guaranteed basic elite benefits, removing the necessity to abide to the original idea of staying a set number of nights. This shifts the program from a pure cost-center to a recurring revenue stream while creating instant loyalty commitment from lower-frequency but high-spending travelers.

4. Web3 and Tokeniz-ed Status

The ultimate trend is the move toward tokeniz-ed status via NFTs or similar technologies. A lifetime status NFT would be owned by the member, not the brand, granting access to benefits across various ecosystems. This solves the perceived issue of status devaluation and provides true portability and ownership of loyalty. While nascent, this provides the technology for the possibility of true cross-brand coalition loyalty, where benefits can be recognized and rewarded regardless of the specific hotel brand, cruise line, or airline to interact with within a larger ecosystem.

The Path to Digital Resilience

Hospitality loyalty programs are at a critical juncture. The current fragmented, point-heavy systems fail to deliver on their promise of simplicity and value, threatening long-term retention. To secure their position as vital marketing assets and EBITDA protectors, programs must embrace personalization, simplify currency across asset classes, and focus on delivering high-margin, experiential redemption options. The future of loyalty is not about points; it is about providing bespoke value and digital resilience that is recognized, consistent, and genuinely rewarding to the customer's entire travel journey.

#HospitalityLoyalty #ExperienceEconomy #LoyaltyRedefined #QQS #HotelTech #FutureofTravel #HospitalityInvestment #CapExStrategy #AssetManagement #FutureOfHotels #DigitalTransformation #NewKPIs #PropTech #experienceeconomy #hotelbusiness #hospitalitytrends #hotelmanagement #guestexperience #hoteltech #revenuegeneration #QQSconsulting #Hospitality #HotelIndustry #HotelOperations #FutureofHospitality #GuestExperience #QQSHospitalityConsulting #TravelTrends #BusinessTravel #ModernTraveler